Africa: The Land of “Almost There” Returns

Here’s the story in numbers: Africa houses about 17% of the global population but captures just around 2% of global private capital commitments. That massive opportunity gap is exactly why a sharp, actionable investment thesis matters now more than ever especially if you’re an LP trying to pick winners, not wishful thinkers. (Bain Global Private Equity Report 2025)

What “Investment Thesis” Really Means

Let me boil it down: a strong thesis does more than state sectors it acts as a litmus test for how a fund sees opportunity, builds value, and tracks progress. Here’s what you actually need:

- Sector clarity: Saying “we invest in fintech” is fluff. You need to specify infrastructure, payments, credit rails, etc. In 2023, fintech commanded nearly 43% of VC funding across Africa, but operationally grounded strategies focused on infrastructure delivered more consistent returns. (source: Disrupt Africa VC Report)

- Geographic precision: Africa isn’t one economy. Focus deeply on 2-4 hubs (e.g., South Africa, Kenya, Egypt, Nigeria) instead of spreading thin across 54 countries.

Sketched exit model: Ask “who buys this business in 5 years?” or “what will a successful exit look like?” Funds with clear exit pathways delivered up to 12% higher IRRs in emerging markets. (McKinsey Global PE Review–alt source via Bain)

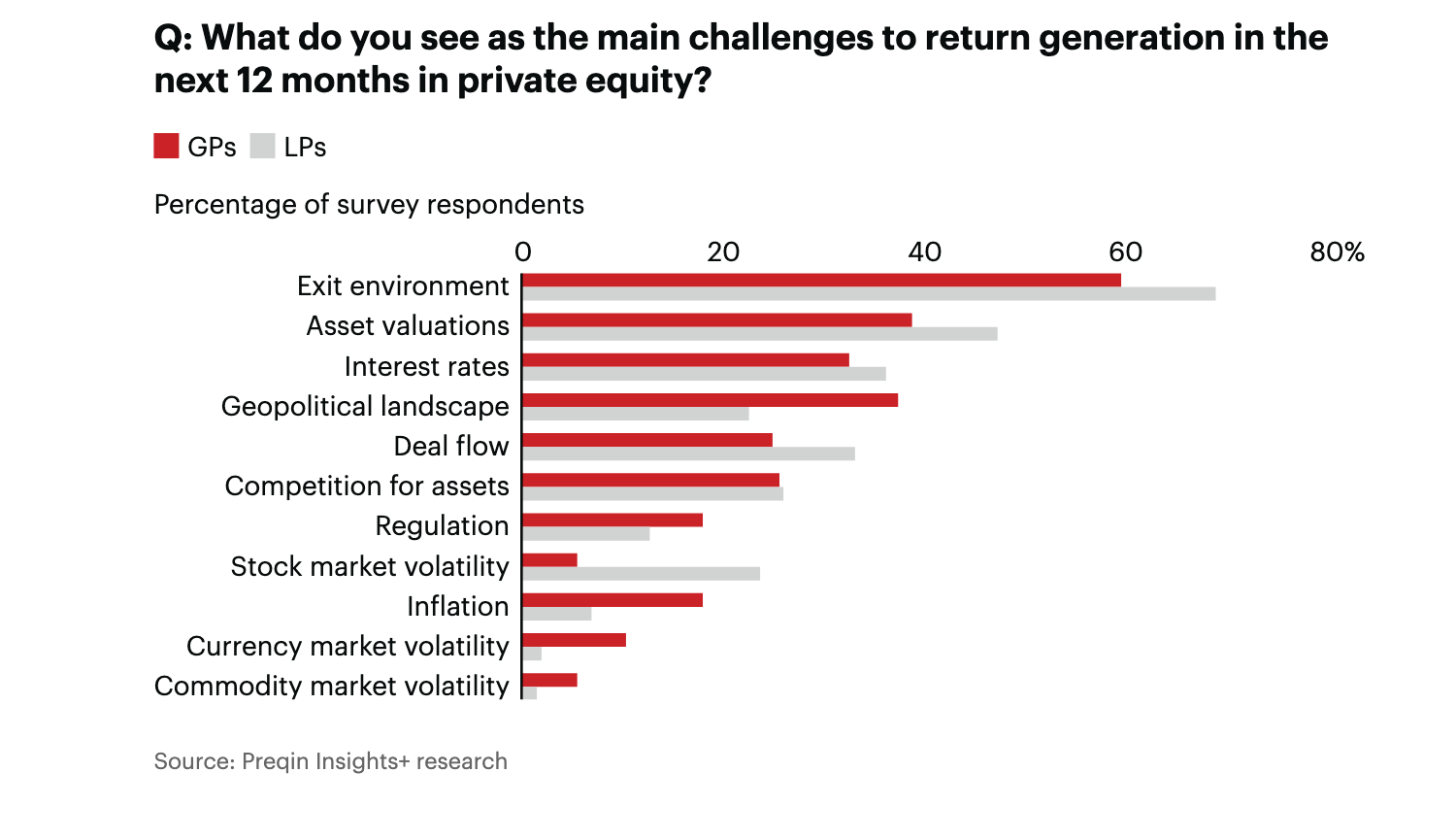

Below is a snapshot of the key hurdles PE funds face when it comes to generating returns.

A Realisation That Changed Everything

Here’s a story: I once worked with a business owner so close to launching their startup that he refused to talk about cash flow, “revenue is king,” he said. Sure, revenue looked pretty, but he could barely pay his team. Six months later, he nearly went out of business. That’s the moment it clicked for me: an investment thesis without operational clarity is the difference between scaling up and scaled failure.

Ocean vs. Pipeline Strategies

Let’s do a quick analogy:

- A “broad thesis” fund is like a fisherman with a wide net. Great if catches are plentiful, but in tight waters, you come back empty-handed.

- A focused thesis? That’s like a diver using a spear. You go deep, precise, and hit the targeted prize.

In Africa’s competitive PE environment, precision wins every time.

Real Foundation: The Operational Playbook

A winning thesis demands more than spreadsheets. Here’s what operational private equity sound funds do:

- Buy-and-build execution – Acquire a core platform, add smaller players, build scale.

- Modernize systems early – Financial reporting, ERP, dashboards, cash controls.

- Leadership alignment – Elevate founders with scaling advisors or hire seasoned operators.

Helios Investment Partners is a great example, they built a strong operating team to systematically add value in African telcos.

Quick Actions for LPs

When evaluating funds, don’t just ask about their strategy, ask for the evidence:

- What operating systems do they build post-investment?

- Who on their team has walked the road from startup to scale?

If it sounds generic, it probably is. A good investment thesis isn’t marketing, it’s survival.

Summary Takeaway: In African private equity, a crisp, actionable thesis is more than intellectual it’s the difference between burning cash and banking returns. Backing operators with clarity is your ticket to systematic alpha.

- African Private Equity Execution Challenges: Why Capital Alone Is Not Enough - January 26, 2026

- From Investment Thesis to Term Sheet in African Private Equity - August 19, 2025