Operational private equity is the solution Africa needs, as throwing money at the problem just doesn’t work.

Let’s be honest: Africa doesn’t have a money problem. Investors keep pouring in billions. The real challenge? Too many businesses here are running on shaky foundations. This is why African private equity needs more than just capital.

Think about it: in 2023, Africa saw 450 private capital deals worth US$5.9 billion, according to the AVCA 2023 Annual Report. Sounds big, right? That was the biggest drop in deal volume in 12 years. At the same time, it was still the fourth-highest deal value since 2012. Mixed signals, yes.

Bain & Company notes that sub-Saharan Africa’s GDP has grown about 5% per year over the last two decades. That’s faster than most mature markets. The opportunity for private equity portfolio operations is massive, but there’s a catch.

Most African companies are still “raw.” They have no proper reporting systems. No scalable processes. No clear metrics. Just hustle, grit, and survival mode. Inspiring? Yes. But a nightmare if your goal is to scale. This is where traditional private equity often drops the ball

Hands-on Private Equity Africa: My Lightbulb Moment

When I was selling my own business, I came across a private equity fund. They asked about revenue multiples, valuations, and EBITDA, but none of them asked about the stuff that actually made the business tick.

- They didn’t ask how we brought in new customers

- What bottlenecks slowed us down

- Which numbers we tracked weekly to stay alive

It was like looking at a speedometer without checking if the car had brakes. That was my lightbulb moment. Too many funds chase numbers, not systems. And without systems, numbers crumble.

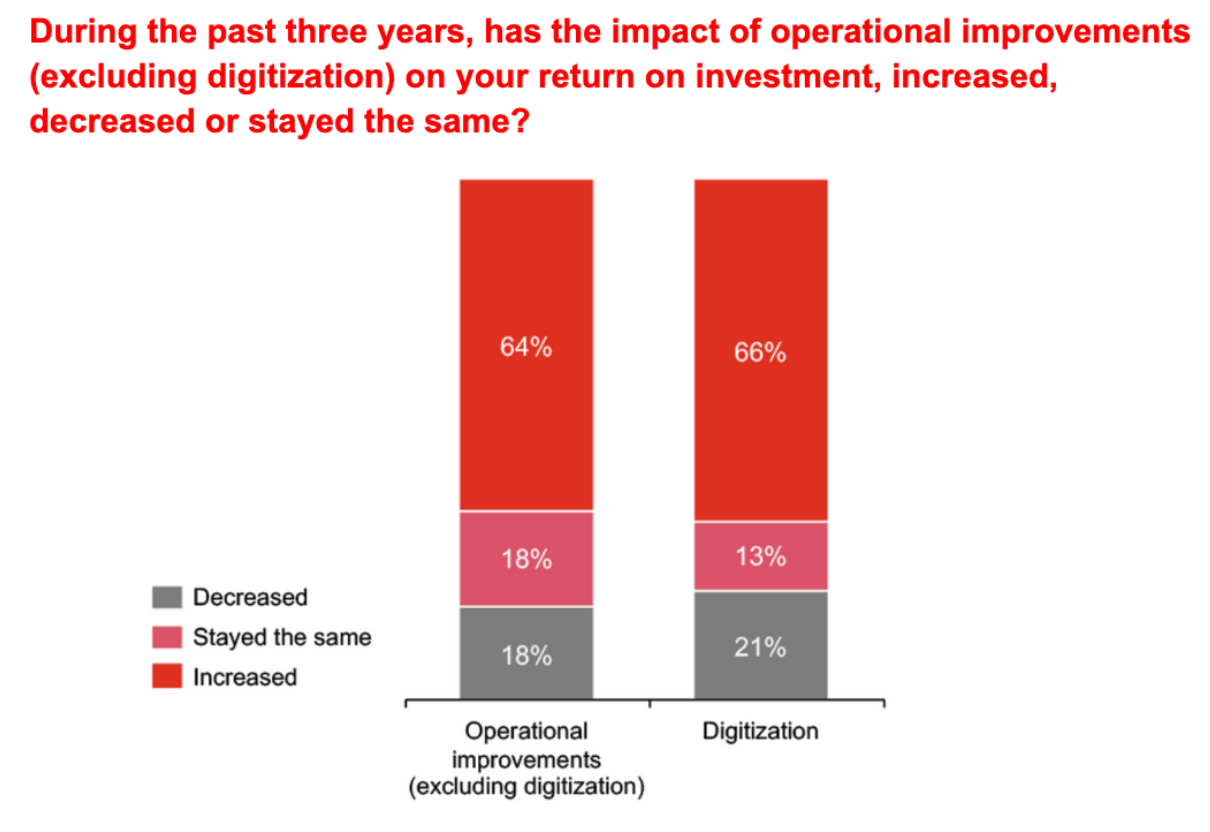

The PwC Private Equity Trends 2025 report highlights that operational improvements, excluding digitalisation, have been a key driver of returns in recent years, with 64% of respondents identifying them as having the greatest impact

Driving Value Creation in African PE: Our Playbook

Being “hands-on” isn’t complicated, but it’s essential. It’s about fixing the fundamentals before scaling. Here’s how we approach operational private equity in Africa:

Executing a Buy-and-Build Strategy to Scale

Acquire a strong “platform” business, then tuck in smaller players around it. This builds scale in fragmented markets like assembling a Lego fortress, one brick at a time. Helios Investment Partners has applied this successfully in telecoms and financial services.

Professionalizing Operations for Financial Clarity

Over 60% of SMEs in Africa struggle with financial visibility, according to the IFC. Many don’t know their true cash position. Step one: proper reporting, KPIs, and financial dashboards. When you can “see” the business clearly, scaling becomes realistic.

Strategic Leadership Transitions

Founders are visionaries, but scaling from 10 to 200 employees requires a different toolkit. The best funds bring in experienced operators or advisors not to replace the founder, but to support them and grow the business.

EBITDA Growth Through Operational Excellence

Improving margins through better procurement, cost efficiency, and streamlined operations often creates more value than chasing flashy revenue growth. Funds with strong operational restructuring consistently outperform, according to AVCA 2023.

The Investor's Advantage: Operational Excellence Private Equity

If you’re an LP looking at Africa, here’s the lesson: don’t back capital-only funds. Ask tough questions around operational excellence in private equity:

- How do you support portfolio companies beyond capital?

- What systems do you install in year one?

- Who on your team has actually run a business, not just modeled one in Excel?

Funds that just wire money might give you a few lucky wins. Funds that focus on private equity portfolio operations? That’s where compounding growth, resilience, and meaningful exits come from.

PE Portfolio Transformation Africa: Our Lighthouse Capital Thesis

Our Private equity thesis Africa is simple: capital without execution is wasted potential. We don’t just wire money and walk away. We embed systems, build processes, and create companies that outlast us. Think of it like aviation: you can give a plane more fuel, but if the engine’s faulty, it won’t get far. Operational private equity is about fixing the engine while the plane is still flying, its the cornerstone PE Portfolio transformation. Tricky? Yes. But if done right, the takeoff is unstoppable.

Education

-MBA (Strategic Management) – University of East London

-Strategic Communications – The London School of Economics

- Operational Private Equity: The Key to Unlocking Value in Africa - August 18, 2025

- Why a Clear Investment Thesis Matters for African Private Equity - July 25, 2025