How to Manage Currency Risk in African Private Equity.

Managing currency risk in African private equity is not optional. Picture this: you’ve made a great investment in a Kenyan fintech. Then the shilling drops 30% overnight, erasing half your paper gains. That’s not drama. It’s the norm in places with volatile currencies.” Past data shows currency devaluation routinely slashes returns by 20–30% in African deals. (source: AVCA/TCX Currency Risk Report)

This isn’t a minor line item. For LPs, understanding FX risk isn’t a nicety it’s mission-critical.

Why Currency Risk Is Underappreciated in African private equity

Managing currency risk isn’t the splashy risk like inflation headlines or political summits. But hidden FX exposure can dwarf underlying performance. That’s why we call it the “silent asset haemorrhage”within African private equity; it’s rarely planned for but often felt.

Effective FX Hedging Strategies for Africa

Steps to take when Managing currency risk:

1. Build Natural Hedges

Funds doing well in Africa align costs and revenues in the same currency zone fintech payments, remittance infrastructure, or export-oriented businesses. That naturally cushions FX swings and improves your fx hedging strategy.

2. Use Professional Hedging Tools

Instruments such as those from TCX and Frontclear offer multi-year hedging tailored for emerging market currencies. Results? Better predictability and steadier valuations.

3. Diversify Across Currencies

Instead of all logic tied to one Shilling, Rand or Naira, well-designed funds spread exposure across 3–5 currencies creating a natural balance sheet as part of your fx hedging strategy.

4. Provide Transparent Reporting

LPs tell me they sleep more easily when they see FX-adjusted returns periodically quarterly updates rather than annual sweeps. That transparency isn’t perfunctory it builds trust.

How Currency Volatility Plays Out Across the Investment Lifecycle In Africa

On paper, African currency volatility looks like a technical problem: you model it in your entry assumptions, maybe budget for a haircut on exit, and move on. But in practice, it shapes the investment thesis from day one.

Take entry valuations. A company priced at 10x EBITDA in local currency may suddenly look like 12x overnight if the shilling weakens before close. That shift alone can destroy a carefully constructed investment case. During ownership, earnings can grow double digits in local terms but still shrink in dollars. And at exit, LPs may find that strong operating performance is masked by translation losses when converting to USD or EUR.

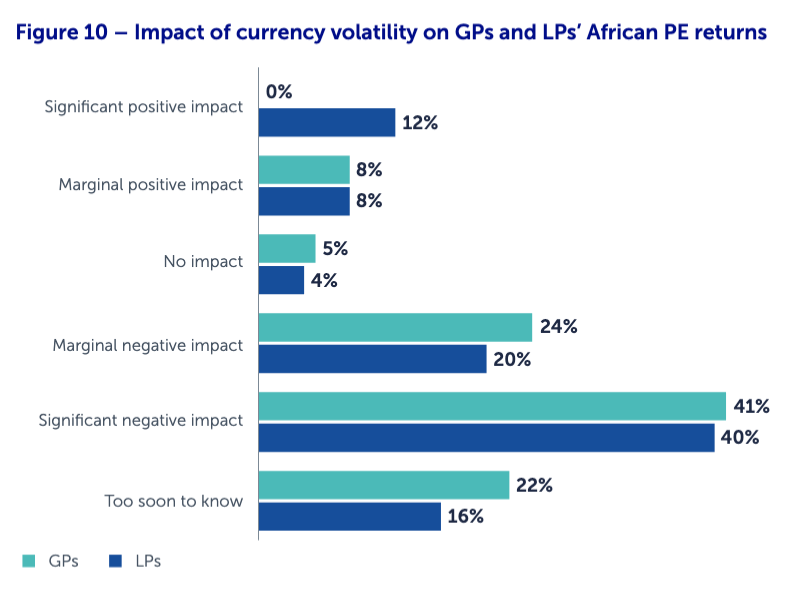

Here’s an interesting reality check: according to AVCA’s Currency Risk in Africa Report (2023), 90% of GPs and 71% of LPs said that the economic performance of African countries was the main factor behind rising currency risk. That ranked higher than COVID-driven macroeconomic shocks (72% of GPs, 50% of LPs) or even political stability concerns (52% of GPs, 57% of LPs).

In other words, the very foundation of FX volatility isn’t just politics or global downturns, it’s the day-to-day economic engines of African markets themselves. And yet, many funds still treat currency exposure within private equity risk management like an afterthought, something to patch over in the financial model rather than designing resilience into their investment approach from the ground up.

My take? FX risk isn’t just an afterthought, it’s a filter. The best managers don’t see volatility as random punishment, they treat it as an X-ray. It reveals which businesses are overexposed and which have the DNA to thrive under pressure.

That’s why at Lighthouse we believe the question isn’t, “How do we avoid FX volatility?” (you can’t). The smarter question is, “How do we build portfolio companies that still create dollar returns despite it?” In other words, we use FX stress tests not just for financial models, but for operating models. If a company’s leadership, pricing, and systems can’t handle a 20% devaluation in year one, it probably won’t make it through the decade.

Currency swings are not just math they’re management. And for LPs, backing GPs who understand that difference is the real hedge

A Founder Story That Illustrates FX Risk

I once worked with a health startup in Nigeria. Their cash flows looked solid until the naira did a 20% dive in a week. Suddenly, that startup’s profit, once $200K, sank to $160K on paper. The founder was scrambling. We stepped in, helped them recalibrate pricing, pushed insurance payments to dollar-denominated collection, and hedged via TCX tools. Within three months, their adjusted margins rebounded. The fix was part of an operational private equity strategy, not financial alchemy.

Why Currency Risk Management Shouldn’t Be “Background Noise” for LPs

Here’s the thing: most LPs I’ve met don’t lose sleep over currency risk management at first. It feels like a background hum, something to “factor in” rather than design for. But in Africa, FX is not background noise it’s the bassline. It shapes every other instrument in the song.

Think about this: AVCA found that 62% of GPs have had exits delayed by FX volatility. That’s not a rounding error. That’s a serious drag on IRR. And for LPs, time is everything. Every quarter of delay compounds into lower net returns.

The deeper issue isn’t the African currency volatility itself it’s predictability. Investors can live with 10% swings if they know when and why. What kills confidence is when a central bank wakes up and devalues the naira overnight by 40%, or when capital controls suddenly make dollar repatriation a nightmare. This ought to make Managing currency risk a top priority.

My view? The LPs who will outperform in Africa over the next decade aren’t the ones who shy away from FX risk Africa. They’re the ones who understand that managing FX risk Africa is part of the operating environment, not an exception.

Education

-MBA in Finance and Entrepreneurship, Bond University, Australia

-BCom in Finance & Economics, University of the Witwatersrand, South Africa

-Advanced Diploma in Bank Credit & Risk Management, Damelin School of Banking

- Managing Currency Risk in African Private Equity - August 20, 2025

- African Private Equity: Strategy, Investment Thesis & Operational Edge - August 13, 2025