African private equity continues to fly under the radar in global conversations, and if you’ve ever wondered why, you’re not alone. Despite being one of the fastest-growing regions in the world, private equity Africa deals often lag behind other markets. This leaves huge untapped potential on the table, despite impressive economic growth year on year.

Table of Contents

ToggleThat’s where operational private equity comes in. Our firm, for example, doesn’t just write a check; we roll up our sleeves to build businesses that last. In this article, we’ll unpack the African private equity landscape, share our African PE thesis, and explain how operational private equity strategies and investment in Africa PE can turn under-invested markets into real growth stories.

From regional analysis and system-led transformations to de-risking execution, there’s a lot to explore. You can learn a lot from what works, what doesn’t, and where the next big opportunities lie, whether you’re a founder, investor, or curious observer

The African Private Equity Landscape - Challenges and Opportunities

Why Africa Remains Under-Invested Despite Strong Growth

Africa is still one of the most under-invested regions in the world. This is especially true when you look at the long-term numbers. According to the AVCA 2023 Annual Report, last year, there were 450 private capital deals worth US$5.9 billion. That’s the steepest drop in deal volume in 12 years. Still, it’s the fourth-highest deal value since 2012.

At the same time, Bain & Company points out that sub-Saharan Africa’s GDP grew at about 5% per year over the past two decades. That’s faster than most mature markets.

So what does that tell us? Two things. One, there’s massive upside. Two, the road is bumpy. You’ve got a shortage of investment-ready businesses. There’s serious competition for the good ones. A lot of companies are operationally… let’s say “raw” compared to their US or European counterparts.

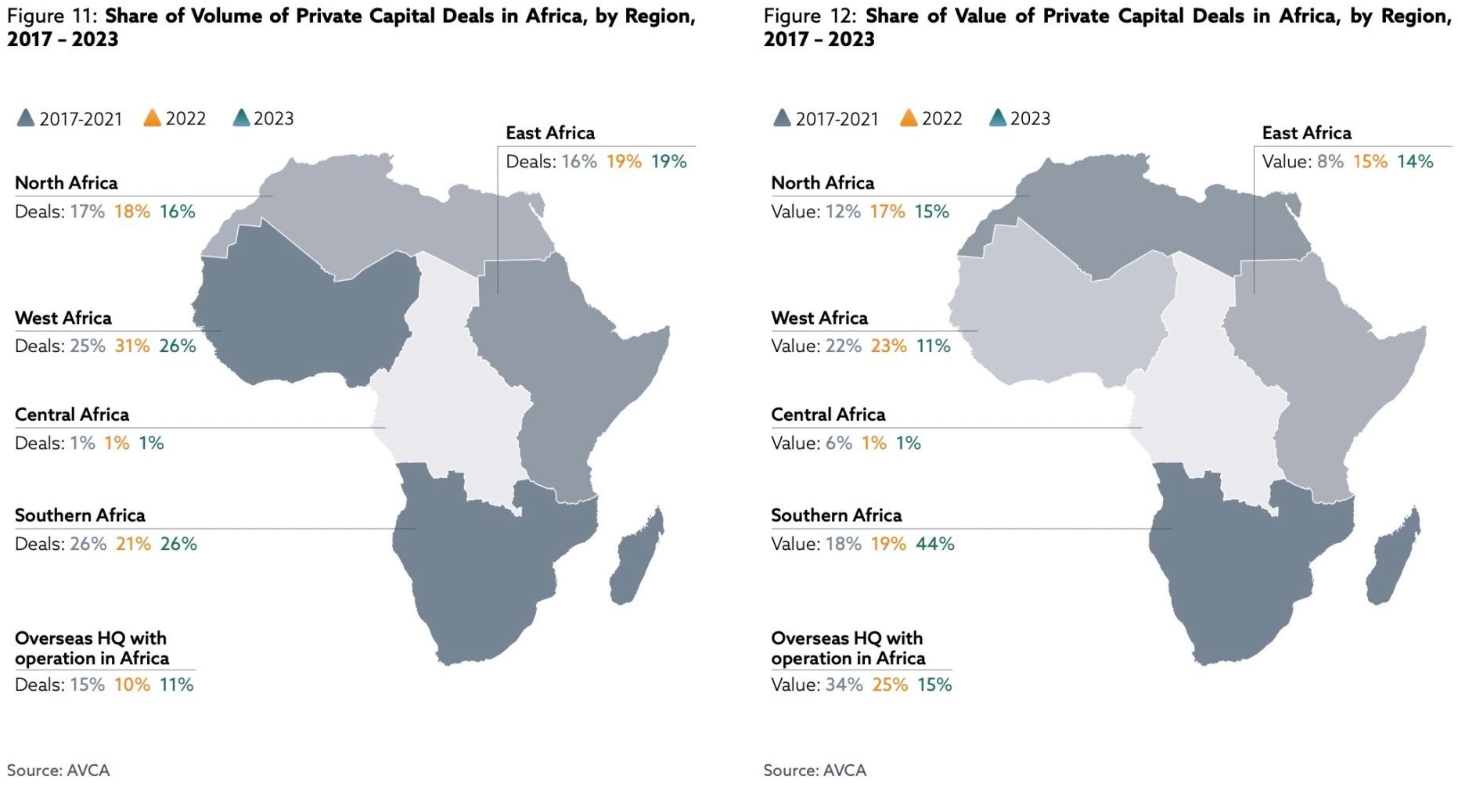

Overview of African Private Equity Deals in Africa 2017 – 2023

The Lightbulb Moment

This opportunity clicked for me when I was selling my own business. That’s when I came across a private equity firm. That’s when it hit me: PE isn’t just about throwing in money and walking away. Done right, it’s about systemising and scaling. That’s the gap in Africa. Too many funds just wire the cash and cross their fingers.

Where the challenges are (and the opportunities hide):

- Many funds still only bring money, not operational muscle.

- Local companies often lack solid systems, financial visibility, and repeatable processes.

- The market’s fragmented. Four hubs , South Africa, Nigeria, Kenya, Egypt , account for 55-64% of deal activity (Africa Global Funds).

AI: The Growth Opportunity Across Key Markets

According to Mastercard’s 2025 report, Africa’s AI sector could expand from US4.5 billion in 2025 to US16.5 billion by 2030. Nairobi and Lagos are already leading the way. The former in AI-based financial services, the latter in intelligent microlending. These hubs could be the next growth engine for operational PE.

Our Investment Thesis for African Private Equity Success

Focused. Founder-Ready. Systems-Driven.

Our sweet spot is founder-led companies making R50M–R300M in revenue. The kind where demand isn’t the problem, outdated systems are. That’s where we come in.

We invest across AI, fintech, data centers, manufacturing, and professional services. We focus on South Africa, Kenya, Nigeria, and Rwanda. If you were Googling Africa private equity investment thesis, you’d find we’re one of the few firms with a clear, actionable strategy, not just a glossy PDF.

Why this works:

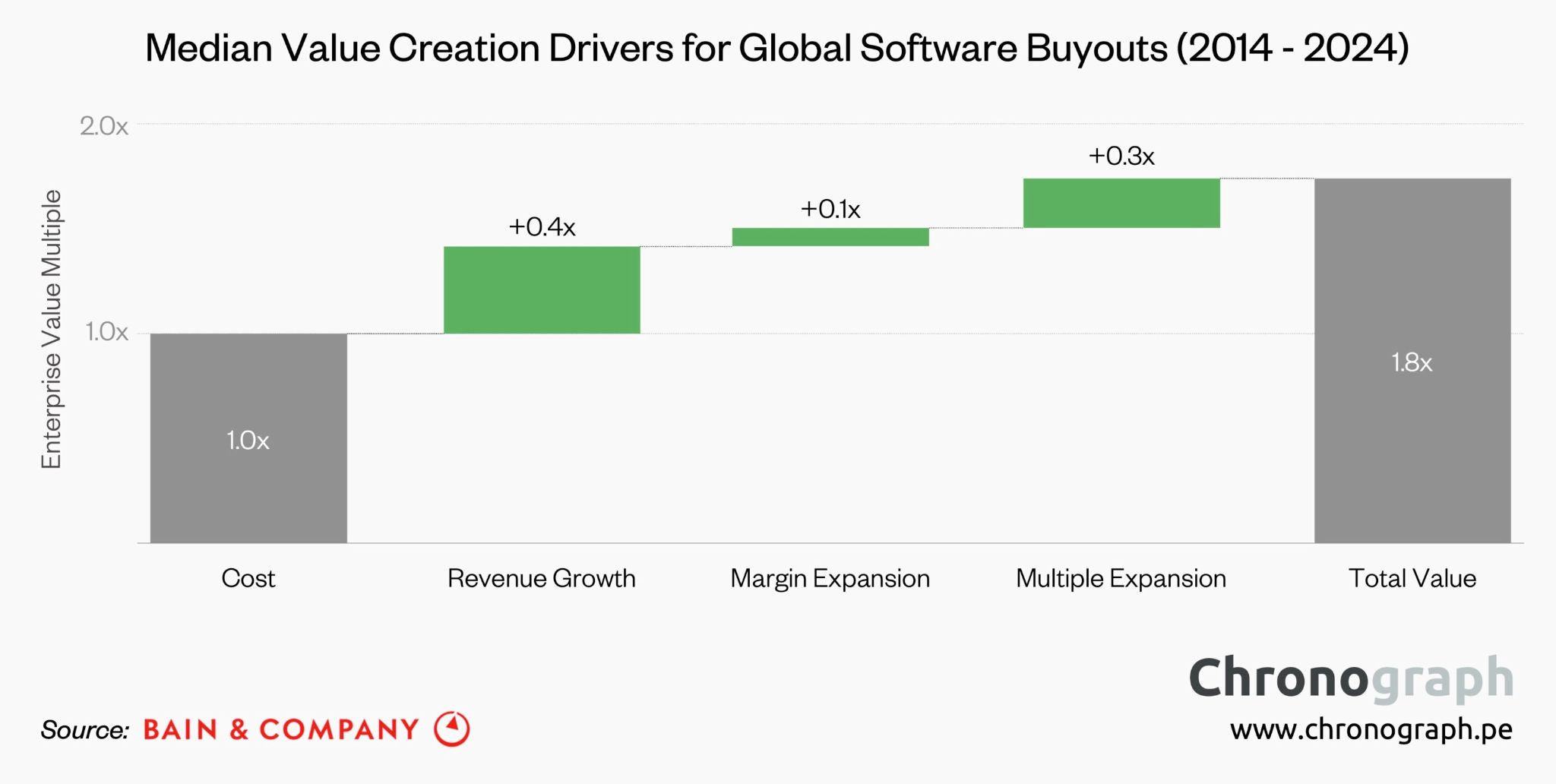

Bain’s research on global buyouts shows that 52% of value comes from revenue growth. 6–10% comes from margin expansion, which is often the difference-maker in top-quartile deals. In Africa, you can’t always rely on multiple expansion. The real wins come from operational value creation. That’s where we use Buy-and-Build strategies, governance upgrades, and tight financial oversight to drive results.

What sets us apart:

Buy-and-Build Execution: We snap up complementary businesses to scale faster and cheaper.

Professionalization from Day One: Financial systems, dashboards, governance routines, and CEO-level leadership are put in place immediately.

Capital Structure Optimization: We use smart refinancing or debt layering to juice returns without overleveraging.

Our belief is simple: founders don’t just need capital; they need a partner in execution. A partner that is the foundation. The thinking is to use the approach to go from investment thesis to term sheet.

Operational Private Equity: Beyond Capital to Operational Value Creation

The Operational Private Equity Playbook: Beyond Capital

Traditional PE in Africa often looks like this: money in, hope for the best. We run a different playbook, one built around fixing the pipes before we try to pump more water through them.

Here’s how we create value:

System Diagnosis:

Pinpointing Inefficiencies for Value Creation by spotting the inefficiencies in finance, ops, sales, and supply chain.

Infrastructure Fixes:

Building the Operational Foundation through CRMs, dashboards, real-time reporting, tools that let leadership see the field clearly.

Leadership Upgrade:

Bringing in or coaching leadership that can actually execute the growth plan.

Execution Cadence:

Aligning Operations with Key Performance Indicators, Weekly leadership standups, and board check-ins to keep momentum.

Real Story: Why Operational Systems Matter :

I met a founder whose team spent three days every week reconciling production numbers in Excel. Three days! They couldn’t see margin erosion until it was too late. We gave them a live dashboard, reshuffled leadership, and set up a weekly performance rhythm. Within months, they landed a regional supply contract, not because of luck, but because they finally trusted their numbers.

Why Operational Private Equity Matters to Investors :

Data backs this up. Chronograph and Bain both show that in today’s market, relying on leverage and multiple stacking is a weaker bet. Operational private equity is the advantage, the ability to actually make a business run better, cuts downside risk and aligns perfectly with Investor goals for sustainable growth.

The Operational Private Equity Model for Value Creation

You know how most African private equity firms are all about just writing the cheque and hoping for the best? Well, we don’t do that. We’re the kind of people who roll up our sleeves and actually write the playbook. Think of us as the crew that not only fuels the plane but also makes sure the pilot knows exactly where to fly and that the whole system runs smoothly.

Our model is built around six main levers that really move the needle:

Building Foundational Systems for Scalable Value Creation:

We kick things off with solid financial reporting, modern IT systems, and clear KPIs. Because honestly, without these basics, even the coolest product won’t take off. (Bain 2025 Report backs this up.)

Strategic Leadership to Drive Growth:

We help founder-led businesses bring in leadership teams that can scale the company, while still keeping that original spark alive. It’s like helping a band upgrade their gear without losing their way of doing things. Our main focus is also using leadership to shape culture and values that would be critical for growth.

Executing a Buy-and-Build Strategy for Accelerated Growth:

We go out and look for smaller businesses that we can scoop up in nearby markets, speeding up growth and grabbing more market share.

Sales & Marketing Acceleration to Drive Sustainable Revenue:

Using our own experience in operations, we reshape sales and marketing strategies so revenue doesn’t just trickle in, it flows. That said, marketing only works when you have decreased customer churn. Spending on marketing while you are still losing customers isn’t a good growth strategy.

Cost Discipline for EBITDA and Margin Growth:

We focus on making operations lean and efficient to boost EBITDA, not just chasing bigger sales. However, we focus on cuttign costs where we see bloated operations, not within core business functions. This isn’t just talk; McKinsey’s Africa Insights shows it works.

Exit-Ready from Day One: Building a Sustainable Exit Strategy:

From day one, every change we make is with a premium exit in mind. So, the business is always ready to shine when it’s time to sell. However, we also ensure that we make sustainable changes balanced with exit planning.

Imagine swapping out the plane’s engine, training the pilot, and upgrading the navigation system all while mid-flight. That’s how we do value creation.

Why Our Buy-and-Build Strategy is Key in African Markets

Africa’s not your usual market. It’s not just about throwing in some capital and watching things grow. Here, you need to get your hands dirty because infrastructure can be patchy, finding great talent is a hustle, and the rules? Well, they can be tricky.

Why traditional african private equity often hits a wall:

- Founders don’t always have access to operators who’ve “been there, done that.”

- Financial reporting and governance often need serious upgrades.

- Growth depends on navigating messy, fragmented supply chains that aren’t your typical corporate setups. (Check out the IFC’s take on Private Equity in Africa).

Our playbook fixes these pain points by:

- Embedding experienced operators right inside portfolio companies, not just advising from afar.

Using tech-powered processes to jump over infrastructure challenges, like skipping traffic by taking a shortcut. - Building systems that don’t just work locally but can scale across regions.

At the end of the day, we don’t ignore the execution risk; we tackle it head-on. That’s how we turn promising businesses into regional leaders.

African PE Market Analysis: A Regional and Country-Specific View

South Africa

South Africaremains the continent’s undisputed anchor market for private capital. It has a vast pool of managers and the deepest exit pathways. AVCA’s 2023 report still shows the Southern African region as the top region by deal value. This reflects South Africa’s role as a hub for larger tickets and better buyouts. The risk story has shifted in 2025, placing the country in a better position compared to 2023, which saw over 300 days of load shedding (power outages).

Improved Macro and Energy Outlook in South Africa

Eskom’s winter 2025 outlook and recent updates indicate a reduction in unplanned power outages. There is a lower prospect of no load-shedding if breakdowns remain at bay. This matters for energy-intensive portfolios such as manufacturing. Performance data supports the allocation of funds to local PE, with the RisCura-SAVCA benchmarks providing a transparent history of pooled IRRs that LPs can underwrite comfortably. Looking at South Africa in general, it remains a strong player in financial services, industrials, and digital infrastructure. It also remains a gateway for pan-African platforms.

The Operator Advantage

Liquidity routes are wider than in most markets. They include trade sales to strategics and regional PE secondary deals, which BCG notes have been the dominant exit mode across Africa. That said, policy risk is not entirely gone. However, the macro picture includes improving energy stability and a sophisticated financial ecosystem. Together, they de-risk execution for operational PE. The implication for an operator-led strategy is clear. You can buy good businesses with solvable constraints, then professionalize, digitize, and bolt on smaller players. That playbook fits South Africa’s depth of management talent and service providers, which shortens time to value creation.

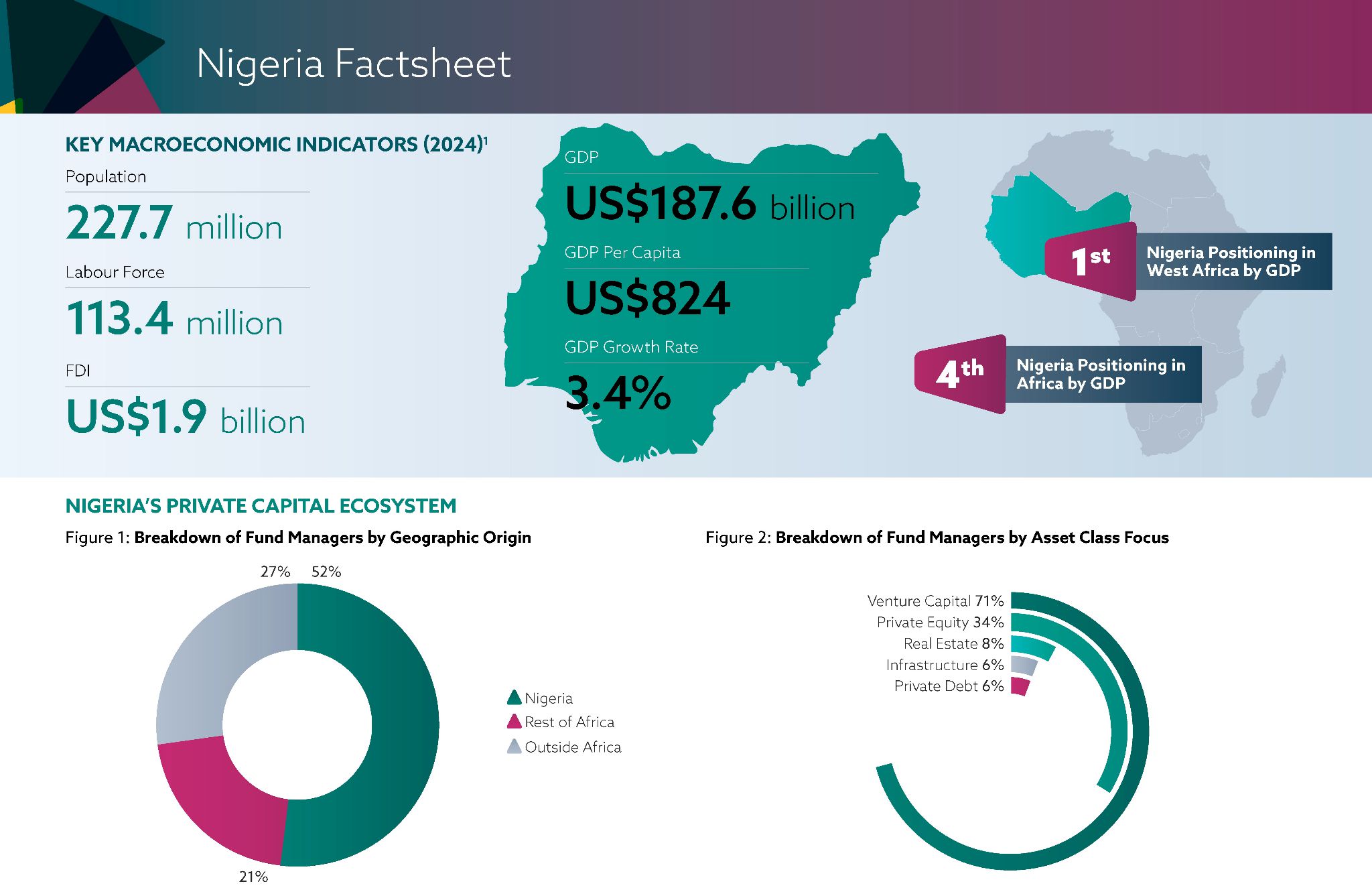

Nigeria

A Scale Story with Macro Volatility:

Nigeria is still a scale story, even after a tough macro reset. AVCA’s Nigeria Spotlight shows it as a top four market by deal count over the past decade. This is driven by financial services, consumer, and energy-adjacent themes. FX reform and fuel subsidy removal in 2023 raised short-term volatility. Yet they also set the stage for a more market-based environment that long-horizon PE can price. Reuters and World Bank updates through 2024-2025 highlight continuing reform intentions. This includes measures to deepen private sector participation. The demand side is not in doubt. With over 220 million people and rapid urbanization, operational fixes that improve distribution, pricing, and working-capital control can move EBITDA quickly.

The Execution Challenge

PE exits in West Africa have been harder in the current cycle. But AVCA and BCG show a pipeline that skews to trade sales and PE-to-corporate deals, which remains viable for scaled Nigerian platforms. The constraint is execution. Currency risk, regulatory friction, and infrastructure gaps require hands-on ops. This includes hedged supply chains, dynamic pricing engines, and shared services for finance and procurement. That is where an operator model earns its premium. The upshot for LPs is asymmetric upside. You can buy right, fix gross margin leakage, and professionalise governance to institutional standards.

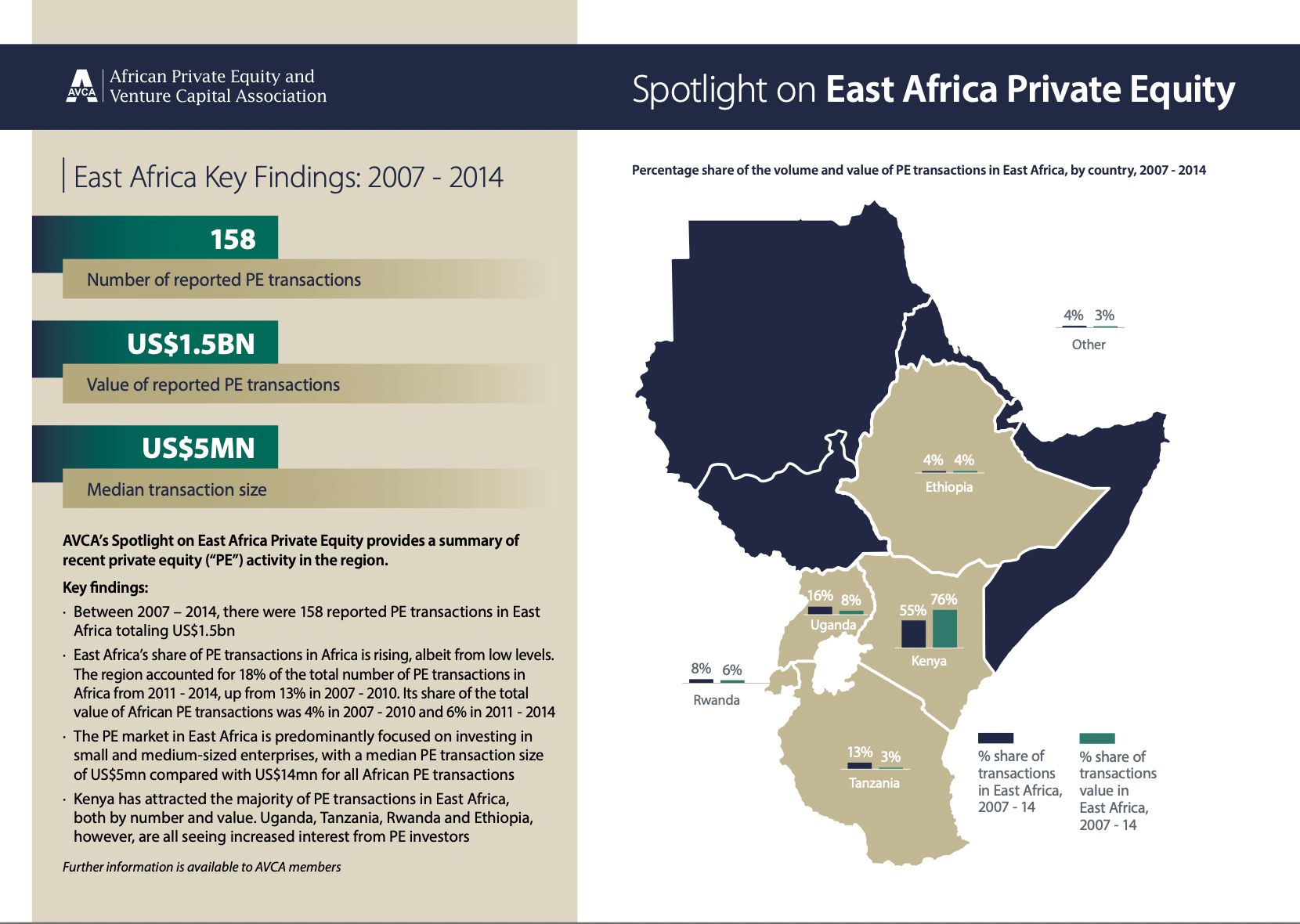

Kenya

East Africa’s Operating Hub

Kenya is East Africa’s operating base, with Nairobi as the region’s finance and tech nerve center. Despite global tightening, Kenya still led East Africa in 2023 deal activity. This totaled roughly 96 deals and about 600 million dollars in value. This underscores the breadth of opportunities from consumer services to clean energy. The macro has been mixed. The World Bank trimmed the 2025 growth outlook to 4.5 percent due to debt overhang and tight credit. However, it expects a gradual rebound toward 5 percent as pressures ease, which is consistent with Kenya’s multi-year growth track.

Practical Operational Levers for Growth

For PE, that means underwriting through a softer credit cycle. Then, you can ride the recovery with operational levers you control. A report by Chambers’ market briefand other regional reviews point to steady African Private Equity participation. Deals are spreading across various sectors, namely, sanitation and distributed energy, which fit an operations-heavy approach. Nairobi is well known to have a great talent pool. It also has a robust digital payments penetration, and phenomenal regional connectivity. This greatly reduces the friction for buy-and-build. The to-do list in Kenyan-based businesses is quite practical. Standardize the reporting, install a cash culture, create hub-and-spoke sales coverage, and negotiate reliable energy inputs. The exit route is usually regional or PE trade sales once EBITDA quality is proven across Kenya, Tanzania, and Uganda

Egypt

Reforms & Market Size

Egypt combines market size with an active reform agenda. The country is under an IMF program , with repeated reviews in 2024-2025. This is alongside World Bank support that emphasises unlocking private sector growth and reducing the state’s crowding-out role. Authorities are pushing privatisations and transfers of state-owned assets into the sovereign wealth fund to accelerate private participation. This can create buyout and carve-out opportunities for capable operators. The macro headwinds are real, from high debt to Suez Canal-related shocks. But the direction of travel is pro-market and could widen deal flow in logistics, renewables, and services.

Operational Alpha as the Prize:

This is where operational excellence wins. For PE, Egypt’s prize is operational alpha in large, under-managed businesses. That means transparent KPIs, cost-to-serve analytics, and commercial excellence that lifts margins despite inflation. According to the IMF, structural reforms within competition and the overall state’s footprint, if maintained, should improve the visibility of exits. The key takeaway for Limited Partners is to back Fund managers who can manage FX exposure. They should also localize procurement operations as well as build export-adjacent revenues to limit macro cycles

Ghana

A Value Build Opportunity

Ghana went through a hard macro reset. It entered an IMF program in 2023 and is working through debt restructuring. World Bank and policy updates flag gradual stabilisation. Inflation is trending down from peaks, and a reform path is aimed at restoring private investment. From a private capital lens, Ghana’s ecosystem is smaller than Nigeria or Kenya. But it offers clean entry points in financial services, agribusiness processing, and logistics that serve the Abidjan-Lagos corridor.

The Operator Advantage in a Smaller Market

Impact Investing Ghana’s market sizing shows an active pipeline. It spans venture to growth equity, which provides co-investment paths and early visibility into scale-up candidates. The operator advantage in Ghana is straightforward. You can professionalize mid-market companies with simple systems. Then, expand regionally into Côte d’Ivoire or Togo. Risk management focuses on FX, procurement, and government receivables. Exits are typically trade sales to regional strategics once you demonstrate multi-country revenue and institutional governance. The result for LPs is a classic value build. Buy at sensible multiples, fix operations, create regional scale, then exit on a higher quality of earnings.

Rwanda

Execution & Reliability

Rwanda punches above its weight on ease of execution. This is why it features in many regional operating plans. The World Bank reports growth of 8.2 per cent on average in 2022-2023 and 9.7 per cent in the first half of 2024. This is driven by construction, manufacturing, and tourism recovery. Kigali International Financial Centre has become a convening platform for private capital leaders. This adds policy access and regulatory clarity that shortens diligence timelines. Rwanda’s opportunity is not about massive deal volume. It is about reliability and speed.

Kigali as the Control Tower

For PE, you can set up shared services. You can pilot standard operating procedures and prove a system before rolling into larger neighbourhoods. The US State Department investment climate statements highlight predictable regulation and investor protection. This helps operational managers hit milestones. The play is to use Kigali as your control tower. Centralise finance and analytics there. Then, run distributed operations across East and Central Africa. Exits are often regional. The value is in demonstrable process quality, which buyers will pay for.

Tunisia

Efficiency & Human Capital

Tunisia is a smaller, efficiency-driven market with strong human capital. It has an established PE anchor in AfricInvest, which signals depth of local investing craft and exit networks. World Bank notes ongoing reforms to improve private sector participation and competitiveness. This can surface carve-outs and growth opportunities in export-oriented manufacturing, IT services, and healthcare. Startup Tunisia and ecosystem analyses show a pipeline of tech-enabled SMEs, often B2B. They can be scaled with sales excellence and customer success systems. The constraint is demand growth at home. So, the operator edge is to build cross-border revenue early, often into France, Italy, or West Africa.

The North Africa Buy-and-Build Node

Tunisia’s advantage is skilled talent and cost competitiveness. The model is to buy capable companies. Install rigorous FP&A. Build channel partnerships in the EU or MENA. Standardise quality to international norms. Then, exit to strategics seeking near-shore capacity. For LPs, Tunisia works best as part of a North Africa node in a broader buy-and-build.

Our Operational Private Equity Track Record: Case Studies in Value Creation

Behind Lighthouse Capital is a powerhouse team with real skin in the game.

Nico Christoforou’s Track Record –

Experienced African Private Equity Professional

Our General Partner, Nic, brings over 25 years of experience. He has worked across Africa, the US, Europe, and Asia. He’s been at the crossroads of African private equity, venture capital, and structured finance. He has partnered with major players like USAID, the Soros Economic Development Fund, Norfund, Rand Merchant Bank, and Deloitte.

Nic has driven more than $2.3 billion in trade and investment deals. This is across sectors like financial inclusion, agribusiness, manufacturing, digital payments, renewable energy, and climate finance. He’s known for combining institutional rigor with a hands-on operational mindset. He works closely with founders and management teams to take companies from early-stage or underperforming to scalable and investment-ready. For example, as part of USAID’s $520 million African Trade & Investment program, he helped mobilize $1.7 billion in trade and close $600 million in investments across 54 countries. That’s the kind of continental and global reach we bring to the table.

Deep Operational Muscle on Our Team

But Nic’s expertise is just part of the story. Our co-founders and General Partners, Anthony and Edwin, also bring deep operational muscle from their years scaling African businesses. Edwin has led growth and digital marketing strategies that have propelled startups to regional dominance. He is also an expert in generating leads and building strong marketing ecosystems that enable sales teams to have real, meaningful conversations with clients, not just cold calls. Anthony trained and worked as an aeronautical engineer. This discipline taught him the value of structured problem-solving, risk management, and building for scale. Today, he applies that same engineering mindset to acquiring and transforming real-world businesses with untapped potential.

Examples in Action:

Edwin’s Track Record- Growth & Operational Value Creation Specialist

Take one fintech success story from Edwin: He helped scale this business’s company that went from zero to over 1,500 products sold and deployed in just eight months. How? By completely retooling their sales and marketing engine, putting in place systems that tracked unit economics in real time, so they could quickly pivot and protect their margins in a volatile market.

Anthony’s Track Record – Aeronatuatical Engineer & Value Creation Specialist

Consider Anthony’s East African tech startup. It solved enterprise client customer service issues by building a solid B2B2C loyalty platform. This was covered by Techweez. Thanks to smart operational interventions, client retention shot up and churn went down. This made the business more sustainable.

This isn’t just talk or theory. It’s proof that when you bring together the right systems, hands-on leadership, and smart capital, African businesses can scale profitably and sustainably. They can also deliver strong returns for Investors. At Lighthouse, Nic focuses on shaping investment strategy, expanding our LP and deal networks, and bringing global best practices to mid-market African private equity. Meanwhile, Anthony and Edwin focus on driving growth through marketing, operations, and lead generation. This ensures our portfolio companies are set up for success from day one. So when you invest with us, you’re backing a team that doesn’t just write the cheque. They write the playbook and know how to get the plane flying higher and faster.

Mitigating Risk to Unlock Investment Opportunities in Africa

In African PE, execution risk isn’t an annoyance it’s the deal killer. McKinsey reports that deal execution delays in Africa take 18–24 months versus much shorter timelines elsewhere doubling holding costs and compressing returns. BCG Global Meanwhile, AVCA finds that 60% of LPs cite currency risk as the top worry when investing in African private equity.

Navigating Complexity & De-risking African Private Equity Investments:

- Due Diligence on Steroids

We go beyond financials. We test procurement reliability, compliance systems, and team capability. All before deploying capital. - Systems Before Scale

Investment only begins when the right sales platforms, reporting dashboards, and operations gates are in place. Harvard Business Review calls this early structure the difference between scaling a company and watching it collapse under complexity. - Location-Specific Playbooks

Lagos doesn’t run like Kampala. Our models are adapted by local infrastructure, risk appetites, and partnerships. - Managing Currency Risk

LPs I’ve met don’t lose sleep over Managing Currency Risk at first. It feels like a background hum, something to “factor in” rather than design for. But in Africa, it’s not background noise, it’s the bassline.

Visibility Through KPIs

We track metrics daily burn, procurement turnaround, weekly customer acquisition cost not just monthly closing. These are early warning systems, often before spreadsheets blink red.

Partnering for Success: How Lighthouse Capital Aligns with LPs

Investor confidence hinges on trust in process. African PE often gets dinged for opaque reporting and lax governance. We’ve engineered against that.

Transparency as Default

Investor receive quarterly deep-dive dashboards complete with operational KPIs, challenges, and pivots not just P&Ls.Disciplined Growth and Planning

Every deal is paired with a 100-day operational roadmap and a 3-5 year value-creation plan aligned to KPIs and exit milestones.Governance That Matches Global Standards

We adopt elements of King IV corporate governance (South Africa’s respected framework), ensuring robust board oversight, strategic alignment, and ethical accountability even in private markets.

The Lighthouse Capital Team: Your Partner for On-the-Ground Presence in Africa

African PE isn’t borderless it’s boots-on-ground. Our advantage lies in team DNA and physical proximity.

- Our co-founders and team lived the African founder life. They’ve negotiated leases at 2 a.m., debugged broken systems mid-cycle, and sold startups under pressure.

- Our GPs have negotiated over $2.3 billion in trade deals.

- We maintain hubs in Johannesburg & Nairobi, not as outposts, but as operational bases where execution teams live and workflows happen.

That’s not common in PE. For LPs chasing risk-adjusted returns, having expert hands and feet across the continent is not a nice-to-have it’s a necessity in order to truly understand the landscape.

FAQs About African Private Equity and Our Approach

Question | Answer |

Why choose Lighthouse Capital over larger PE firms? | We move with speed, clarity, and execution, driving results when scale and agility matter most. |

How do you source deals? | Through deep founder networks across Africa’s growth hubs often seeing opportunities before competition. |

What’s your typical ticket size and hold period? | Equity checks from US$5M to $20M, with a typical hold of 3-7 years, aligned with operational rhythms. |

How do you manage operational risk? | Only deploy scale capital once systems, leadership, and execution cadences are in place. |

What return metrics do you target? | Aiming for 3x-5x MOIC, blending cash flow generation with growth upside. |

Education

-MBA in Finance and Entrepreneurship, Bond University, Australia

-BCom in Finance & Economics, University of the Witwatersrand, South Africa

-Advanced Diploma in Bank Credit & Risk Management, Damelin School of Banking

- Managing Currency Risk in African Private Equity - August 20, 2025

- African Private Equity: Strategy, Investment Thesis & Operational Edge - August 13, 2025